October 01, 2024

Kara Murphy, CFA – Kestra Financial

As the presidential election gets down to the wire, we’re fielding a lot of questions about where the candidates stand on issues with big economic implications. It’s not hard to see why investors still have plenty of questions.

Recall that it’s been less than three months since President Biden decided to step aside and hand the mantle to Vice President Kamala Harris. In addition to that unexpected twist, the Harris-Trump matchup has been heavy on political rhetoric but somewhat lighter on proposed policy details than many past races.

In this week’s Markets in a Minute, we tackle a few questions that are top of mind for many advisors and their clients. This isn’t meant to be exhaustive list of each candidate’s set of proposals, but a broad look at the similarities between the two (a surprisingly healthy list) and their differences on a handful of key issues.

What may happen with taxes under Trump versus Harris?

There are certain tax breaks that both candidates support. Both, for instance, have come out in favor of increasing the federal Child Tax Credit, enacted in 1997 and temporarily expanded under the pandemic-era American Rescue Plan. Harris and former President Trump have also proposed exempting tips from income tax, although, in practice, doing so would introduce a host of challenges.

Trump has taken things a step further, also proposing to exempt Social Security benefits from income tax. Here are some other ways in which Trump and Harris differ on taxes:

Individual Taxes

Not surprisingly, Trump wants to extend the tax breaks he put in place under the Tax Cuts and Jobs Act of 2017. Harris would let portions of the bill expire, as scheduled, at the end of next year, although she has been careful to try to insulate a wide swath of Americans. More specifically, she has pledged not to raise taxes on households earning less than $400,000 annually.

At the same time, Harris has taken aim at certain taxes that have big investment implications, proposing, for instance, to raise rates on long-term capital gains and net investment income. Trump would preserve the current rates in these areas.

It’s worth noting that many of her proposals in this area are specifically targeted to the highest-income earners. With regard to the long-term capital gains tax, for instance, she wants to raise the rate only for households earning more than $1 million a year. She has also proposed a minimum 25% tax on total income (including unrealized capital gains) for taxpayers with wealth that exceeds $100 million, or what’s become known as the billionaire minimum tax.

Corporate Taxes

Under the Tax Cuts and Jobs Act, Trump lowered the corporate tax rate substantially, from 35% to 21%. This time around, he aims to go further, dropping it to 15%. Harris, meanwhile, has called for increasing the rate to 28%. That would undo about half the cut that Trump put in place but keep the overall rate below pre-Trump levels.

Where do the candidates stand on tariffs and what are the potential impacts of their proposals?

While Harris hasn’t really commented on tariffs – except to criticize Trump’s proposals – the Biden-Harris administration has kept in place many of the tariffs that Trump enacted while implementing additional tariffs on targeted goods. So, the question becomes: How many more tariffs will we have (as opposed to how many we remove)?

For his part, Trump wants to double down on tariffs in a second term, pledging to impose a blanket 60% tariff on goods made in China and a tariff of up to 20% on everything else the U.S. imports. He has also threatened to impose harsher tariffs on Mexican-made goods.

In theory, there can be good reasons to use tariffs, which are taxes on imports that are paid by U.S. companies to the federal government. Countries around the world use them to give important industries time to develop without heavy foreign competition. Countries also use tariffs for political reasons, including to avoid becoming overly reliant on essential products made by foreign adversaries.

The tradeoff (pun intended) is that tariffs tend to inflict near-term economic pain, slowing down trade and ultimately raising costs for consumers. Early research suggests that additional tariffs could have negative implications for economic growth and inflation, depending on their scope.

What have the candidates said about the national deficit?

Surprisingly little actually. In fact, the issue got little more than a passing mention during the first presidential debate. Harris broached the topic but did so by arguing that her opponent’s economic policies would “explode” the deficit.

On the campaign trail, Trump has argued that stiffer tariffs would help shrink the deficit, among other purported benefits. In fact, the U.S. now collects about $100 billion a year in customs revenue, and that figure would meaningfully increase if Trump is able to follow through on his tariff-related proposals.

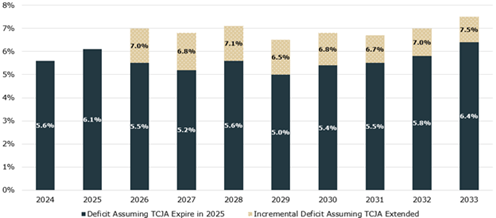

Regardless of who sits in the White House in January, the deficit will be the big winner of this election. Even without new spending or an extension of Trump-era tax cuts, yearly deficits are expected to remain elevated for the foreseeable future because of higher spending on Medicare, Social Security benefits and interest expenses.

Deficit Projections

NOTE: This material represents an assessment of the market environment at a specific time and is not intended to be a forecast or guarantee of future results. Source: PIMCO, Congressional Budget Office, The Budget & Economic Outlook, The Tax Foundation. Data as of April 2024.

The candidates’ relative silence on the deficit shows that it’s an American problem – not just a party problem – and one so big and intractable that the next president isn’t likely to be able to make much of a near-term impact. Still, he or she will certainty have to manage the problem.

The Road Ahead

In this analysis, we’ve focused on what each candidate has said on the campaign trail. In reality, what the next president can actually do is likely to look at lot different than the pledges made in the heat of an election. As history has shown, the business of governing is messy and typically involves a lot of compromise.

We’ll keep a close eye on how fiscal and trade policy unfold during the next administration, along with regulations, geopolitics and other issues with big economic implications. A great source of information on national and local elections is the League of Women Voters’ VOTE411 guide, which provides a non-partisan summary of candidates’ political platforms. Check it out and, as always, don’t forget to vote!

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. Does not offer tax or legal advice.